Tax percentage taken from paycheck

Web From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Web 4 rows How do you calculate taxes taken from your paycheck.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

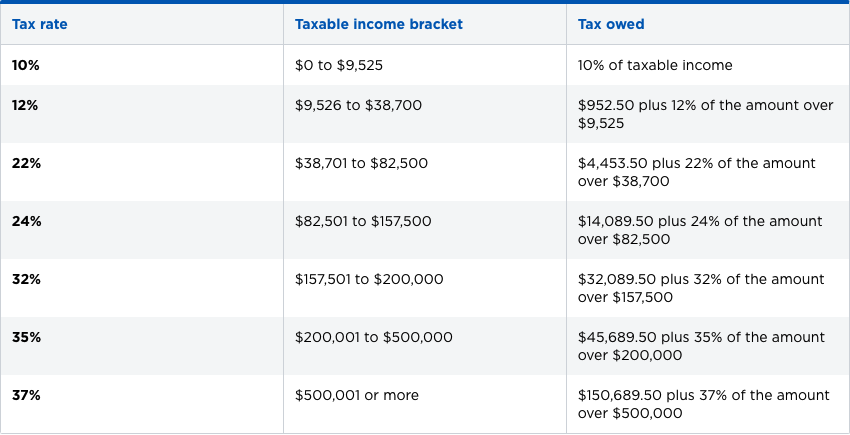

. 10 12 22 24 32 35 and 37. Use this tool to. Estimate your federal income tax withholding.

Web Residents pay 1675 of their net state tax while non-residents pay 05 of wages. Web How It Works. This is divided up so that both employer and employee pay 62 each.

If you make more than a. If you make 120000 a year living in the region of California USA you will be taxed 38515. Web Social Security tax 124.

Add the taxes assessed to determine the. 10 percent 12 percent 22 percent 24. Web Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings.

Web Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. Typically employees and their employers split that bill. Web Add up all your tax payments and divide this amount by your gross total pay to determine the percentage of tax you pay.

Web How to Calculate Taxes Taken Out of a Paycheck. Web Federal income taxes are paid in tiers. The federal withholding tax rate an employee owes depends on their income level.

You pay the tax on only the first 147000. Web They take a big bite out of paychecks each month and just how big depends on where you live. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145.

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. Web How much taxes do you pay if you make 120000. Web There is no income limit on Medicare taxes.

The federal income tax has seven tax rates for 2020. The employer portion is 15 percent. Another thing worth noting is that certain self-employed taxpayers in New York City as well as Richmond Rockland Nassau Suffolk Orange Putnam Dutchess and Westchester Counties have to pay a metropolitan commuter transportation mobility tax MCTMT of up to 034.

Web How much federal tax is taken out of your paycheck will also be determined by your tax bracket the more income you earn the higher percentage tax bracket you. Web What percentage of federal taxes is taken out of paycheck for 2020. For the 2019 tax year the.

For a single filer the first 9875 you earn is taxed at 10. See how your refund take-home pay or tax due are affected by withholding amount. The federal government receives 124 of an employees income each pay period for Social Security.

Web These taxes are deducted from your paycheck in fixed percentages. These amounts are calculated and deducted from earnings after all pre-tax contributions to retirement plans. The next 30249 you earn--the amount from 9876 to 40125--is.

Web A short-term for Federal Insurance Contributions Act FICA taxes serves as social security and Medicare taxes paid by each individual working under a US-registered company. Web The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Web The federal withholding tax has seven rates for 2021.

The Social Security tax is 62 percent of your total pay until you reach an. For example if your gross pay is 4000 and your total tax payments are 1250 then your percentage tax is 1250 divided by 4000 or 3125 percent. If youre single and you live in Tennessee expect 165 of your paycheck to go to taxes and thats the state with the lowest tax burden in the nation.

There is a wage base limit on this tax. Web Every employee is taxed at 62 percent for Social Security and 145 percent for Medicare.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Understanding Your Paycheck Credit Com

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2022 Federal State Payroll Tax Rates For Employers

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Payroll Tax What It Is How To Calculate It Bench Accounting

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

2022 Income Tax Withholding Tables Changes Examples

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Let S Talk Taxes Infographic It S A Money Thing Kalsee Credit Union Tax Money Tax Money

Federal Income Tax Brackets Brilliant Tax